- At a Glance

- Reporting and Transparency

- ESG Ratings and Rankings

- Environment

- Social

-

Governance

- Sustainability in the Supervisory board

- Bayer Sustainability Council

- Bioethics Council

- UN Global Compact

- Product Stewardship

- Supplier Management

- Group Regulations

-

Group Positions

- BASE

- Bioethical Principles

- Protection of Biodiversity

- Position on Global Product Strategy

- Position on Responsible Care

- Position on Deforestation and Forest Degradation

- Position on Insect Decline

- Raising the Bar on Crop Protection Safety Standards

- UN Sustainable Development Goals

- Position on Sustainable Beef Production

ESG Ratings and Rankings

For many stakeholders it is difficult to decide, whether a company can be seen or classified as “sustainable”. For decades, the so called ESG rating agencies have been focusing on exactly this question: using comprehensive and proprietary methodologies, ESG rating agencies assess multiple indicators especially on environmental, social and governance topics (ESG) and measure a company’s respective risk exposure as well as the performance on how these ESG risks are being managed. The methodologies used by the ESG rating agencies differ in particular with regard to which ESG topics are considered to be material for the assessment.

The results published by these ESG rating agencies are commonly referred to as “ESG ratings”. Listed companies like Bayer are assessed by multiple ESG rating agencies - often publishing heterogenous results.

The basis for the ESG rating agencies’ assessments is Bayer’s Sustainability Report, which is published annually. We constantly screen the requirements from ESG rating agencies and aim to provide the respective data and information as part of our comprehensive reporting, which undergoes auditor’s assurance before being published. Through this increased transparency on ESG topics and through targeted and constructive dialogue, we have made significant progress in recent years with what we consider to be the most important ESG rating agencies and ESG rankings. This includes clearing the red flags from MSCI ESG Research in 2022 and from ISS-ESG in 2021 as well as improved ESG ratings from all relevant issuers. In addition, an outstanding scoring from EcoVadis secures Bayer’s position as a supplier to other companies.

A short description and explanation of some selected ESG ratings and rankings is listed below (click on the arrow to use the hide-flip function).

Bayer’s Sustainability Ratings

On a scale from AAA (best grade) to CCC (worst grade), Bayer was rated A in 2022 by the rating agency MSCI and is thus in the industry average of the pharmaceutical companies examined.

Also, MSCI ESG Research updated the ESG Controversies Report on Bayer, including a reassessment of the critical section on “Environmental concerns over GMO crops”. The red flag related to this controversy was removed and Bayer’ rating improved from BB to A. The latest report is available in MSCI’s ESG Manager.

During the last years, Bayer was in continuous discussions with MSCI ESG Research and provided substantial information for their assessment. To specifically address concerns related to GMO crops, we published our Report about Genetically Modified Crops.

About the rating

The MSCI ESG Rating measures a company's resilience to long-term, industry-relevant environmental, social and governance (ESG) risks and their ability to manage those risks relative to peers.

On a scale from A (best grade) to D, Bayer was rated B- by the rating agency ISS ESG in 2023, making it one of the top 10% of all companies in the chemical industry examined. The so-called “prime status” with the classification (B-) was reached for the first time this year.

In 2021, ISS ESG removed its red flag on Neonicotinoids after we published a report in April 2021, in which we presented our measures for the safe application of the neonicotinoids class of insecticides, which have been the subject of criticism in some cases. The report focused on the systematically improved mechanisms to mitigate risks related to the various individual applications for crop protection products and on the implications for the further development of our product portfolio. In conjunction with our continuous dialogue with the ISS ESG rating agency, this publication achieved a significant improvement in the agency’s standards-based assessment of Bayer through the lifting of a “red flag.”

About the rating

ISS ESG is a rating agency in the sustainable investment segment that examines companies according to a large number of ecological, social and governance criteria. The areas of employees and suppliers, social responsibility and product stewardship, corporate governance, sustainability of products, environmental management and eco-efficiency are regularly assessed.

The Sustainalytics ESG Risk Rating evaluates the sustainability performance of companies in five risk levels on a scale from "negligible" to "severe". Bayer was classified in the “medium risk” category in 2024 with a score of 26.6. Bayer is thus above the sector average of the pharmaceutical industry defined by Sustainalytics.

About the rating

Sustainalytics' ESG Risk Rating defines financially significant ESG risks in companies' portfolios and assesses how these risks could affect performance.

Moody’s analytics (former Vigeo Eiris) assesses a company’s ESG performance along various criteria such as Environment, Human resources, Human rights, Community involvement, Business behavior and Corporate Governance. In 2023, Bayer scored 55 (out of 100) which is far above the sector average defined by Moody’s.

About the rating

Moody’s assessments measure the degree to which companies manage ESG factors. Assessments are based on double materiality and include external environmental and social risks to financial performance, but also how businesses impact the environments and societies in which they operate.

In 2024 Bayer was again confirmed in the FTSE4Good Index. Companies that meet strict ecological and social criteria, such as environmental management and climate protection, employee rights, anti-corruption, sustainability in the supply chain and sustainability reporting, qualify for the index. Moreover, FTSE Russel also offers an ESG rating in which Bayer scored 4.2 (of 5) and ranges in the Top 10 of the subsector average.

About the index

The benchmark series of “FTSE4Good” indices are a series of indices initiated by the Financial Times and the London Stock Exchange (FTSE), which have a high priority in the international sustainability indices. Bayer has been listed since the series was established in 2001.

For the sixth time, the international rating agency for sustainability evaluations EcoVadis extensively assessed Bayer and once again awarded it the “advanced“ level for its company-wide sustainability management. With a scoring of 75 (out of 100) Bayer places among the top 2% of the companies assessed in the Manufacture of basic pharmaceutical products and pharmaceutical preparations industry.

EcoVadis analyzes companies’ sustainability performance in four categories – Environment, Labor & Human Rights, Ethics, and Sustainable Procurement.

About the rating

EcoVadis has been operating an independent collaborative platform that prepares CSR ratings of suppliers for global supply chains since 2007. EcoVadis has set itself the goal of promoting companies’ environmental and social practices through CSR performance monitoring within the supply chain and supporting them in improving their sustainability.

CDP (formerly the Carbon Disclosure Project) has awarded Bayer the rating of A– for its Climate strategy. We also achieved good results in the areas of Water (A–) and Forest (B). The company has been included in the CDP rankings since 2005.

Many investors make use of ESG ratings and include the results in their analysis whether a company can be selected as “sustainable” and therefore in the decision making whether to invest in a company – or not. Other stakeholders also make use of ESG ratings on Bayer, e.g., our partners and customers, to ensure they are doing business with a company rated as “sustainable”.

In their assessment, ESG rating agencies mainly analyze publicly available data and information on a company, as well as external assessments and in many cases also a collection of press articles mentioning the company. Understanding the relevance of ESG ratings for our stakeholders, Bayer has been maintaining a constructive dialogue with leading ESG rating agencies for years, aiming to achieve a fair and transparent ESG assessment of our company’s efforts – not only regarding our sustainability activities. While doing so, we also gain comprehensive feedback from the stakeholder group of ESG rating agencies and learn about their view on sustainability and their expectations of companies like Bayer.

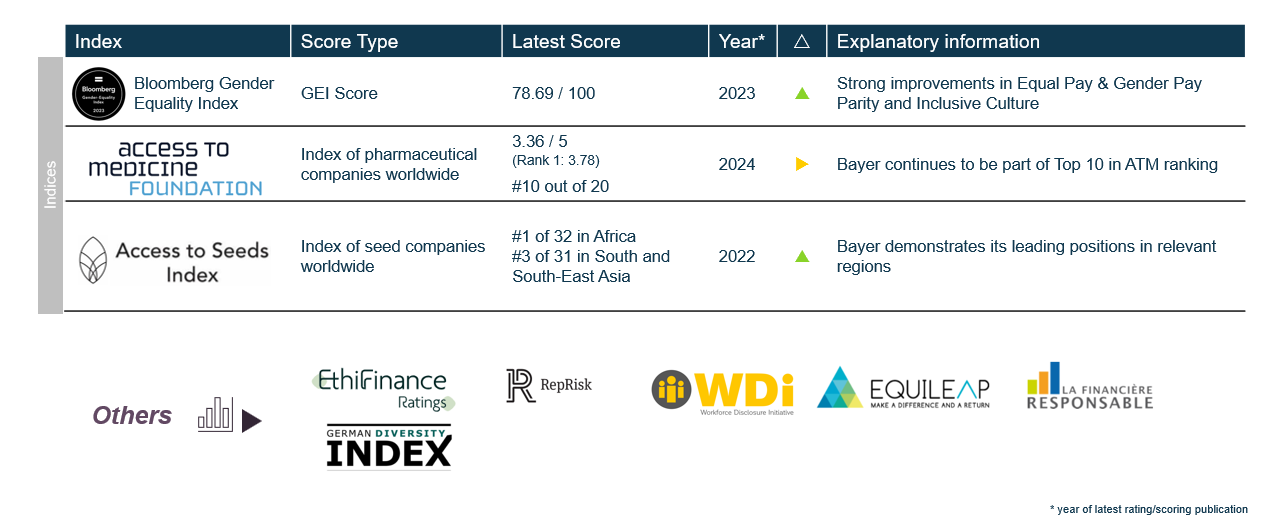

Bayer’s Sustainability Indices and other ratings

Besides the global and common ESG rating agencies’ surveys, many other inquiries on sustainability issues are performed, which are equally important as they take a deeper look into divisional and functional areas and their ESG performance. They do not provide a dedicated “ESG scoring” but a comprehensive comparison between peers and competitors for a certain field of activities. Most prominent examples for these indices are the “Bloomberg Gender Equality Index”, the “Access to Medicine Index (ATM)” and the “Access to Seeds Index”.

In recognition of our efforts for an equal and inclusive corporate culture, Bayer was one of the few German companies to be included in the Bloomberg Gender Equality Index again in 2023. Bloomberg Gender Equality Index is one of the most respected ratings on gender equality especially amongst investors. With less than 10 companies headquartered in Germany included in the index, Bayer is included for the fourth consecutive year.

About the index

The Bloomberg Gender-Equality Index includes listed companies that have a proven track record of promoting gender equality. Criteria for acceptance include the proportion of women in management positions and the measures implemented by the company to promote talent and equal pay for women, an inclusive corporate culture and protection against sexual harassment.

Improving global access to health care is an important part of our sustainability strategy. Every two years, the Access to Medicine Foundation ranks 20 of the world's largest pharma companies on how they perform in improving access to medicine for people in low- and middle-income countries (LMICs). In the Access to Medicine Index 2024, Bayer was ranked 10th. With that, Bayer has achieved a Top Ten ranking in a second consecutive assessment cycle.

Improving global access to health care is an important part of our sustainability strategy. Every two years, the Access to Medicine Foundation ranks 20 of the world's largest pharma companies on how they perform in improving access to medicine for people in low- and middle-income countries (LMICs). In the Access to Medicine Index 2024, Bayer was ranked 10th. With that, Bayer has achieved a Top Ten ranking in a second consecutive assessment cycle.

About the Index

The “Access to Medicine Foundation“ was founded in the Netherlands with the aim of improving access to sustainable health care, especially in developing countries. Every two years, the Access to Medicine Foundation reports on how 20 pharmaceutical companies are making medicines, vaccines and diagnostics more accessible to people in 126 low- and middle-income countries. The Access to Medicine Index 2022 comprises 82 diseases, conditions and pathogens that are analyzed in three technical areas: "Governance of Access", "Research & Development" and "Product Delivery". The supporters of this global initiative include the Bill & Melinda Gates Foundation, the Dutch Foreign Ministry and the UK AID as well as over 50 institutional investors.

The Access to Seeds Index of the World Benchmarking Alliance (WBA) compares seed producers’ efforts to help smallholder farmers in LMICs. The 2021 index compared 67 seed companies in three regions. Bayer took the top spot in the Western and Central Africa and Eastern and Southern Africa regions and placed third in the South and Southeast Asia region, in part for our establishment of support programs to strengthen smallholder farmers.

About the index

Every second year, the Access to Seeds Index assesses seed companies on their efforts to make quality seeds accessible to smallholder farmers. By providing insights into companies’ performance, presence and portfolio, the index aims to contribute to building partnerships with the seed industry.